Multi state paycheck calculator

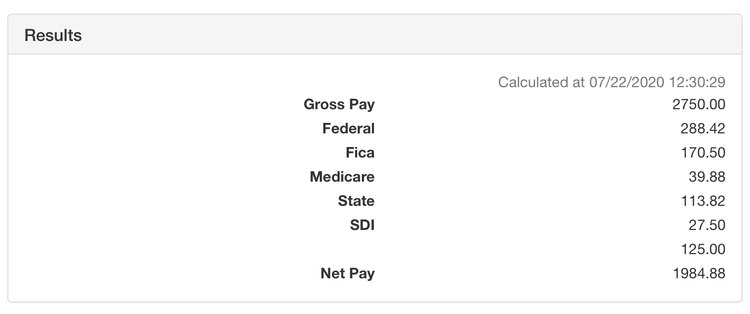

The state transfer tax is 070 per 100. This tool allows people to not only calculate federal and all state withholding but also FICA tax.

A Small Business Guide To Doing Manual Payroll

Self-employed individuals need to take the Medicare and Social Security amounts from the calculator and subtract it from net income to obtain an accurate number.

. From stock market news to jobs and real estate it can all be found here. Founded in 1960 by a group of forward-thinking employees at Fairchild Semiconductor today we continue to be an industry leader providing innovative financial products for all stages of our members lives including personal banking wealth management. Online payroll for small business that is simple accurate and affordable.

PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals small businesses and payroll. The Citizens Scholarship Sweepstakes is open to legal residents of the 50 United States DC and US. New Hampshire and Texas have high property taxes in relation to home values.

South State Bank does not provide and is not responsible for the products services overall content security or privacy policies on any. For this example we will enter 72 as the age. No purchase necessaryVoid where prohibited.

While much of the world is battling high single-digit inflation this year Argentinas struggles are in a different category. Run your first payroll in 10 minutes. Sign In to access I-TIME timesheets Pay Stubs Employee Self Service W-2s and other State Controller s Office Web Applications for State Employees Agencies and Vendors.

Official Code 32-54101 et seq the Act and Mayors Order 2018-36 dated March 29 2018 hereby gives notice of the intent to amend Title 7 Employment Benefits of the. This calculator is for 2022 Tax Returns due in 2023. Additionally if you live in one of the five boroughs youll pay extra taxes specific to the city.

Unfortunately for those moving from almost any other state in the US New York will seem mighty expensive. On top of sales tax hovering near 9 New York charges state income taxes that can tally up to an expensive percentage of your paycheck. Before sharing sensitive information make sure youre on a federal government site.

Enter your businesss start date. There is an additional surtax of 045100 but only for multi-family or larger dwellings. IMPORTANT information for Windows XP Users After December 4 2016 you will no longer be able to access your 529 plan accounts using Windows XP.

If the home you buy is located in Miami-Dade County the tax rate is 060 per 100. NMLS 1136148 a subsidiary of Intuit IncIn California loans are made or arranged by Intuit Financing Inc. The Director of the Department of Employment Services DOES pursuant to the authority set forth in the Universal Paid Leave Amendment Act of 2016 effective April 7 2017 DC.

Paycheck City is a free online withholding calculator. Since they dont collect income tax some states generate revenue in other ways. The start date should match the date listed on the businesss Secretary of State filing.

Illinois has reciprocity with these four states so residents can cross state lines to work there without worrying about paying income tax to their non-resident state. For additional information please click the symbols throughout this page to view our student lending disclosures. Verify youve selected the right business type.

Tennessee has one of the highest combined state and local sales tax rates in the country. As an example we will enter 100000 as the account balance. All 50 states and multi-state.

Paycheck Protection Program Loan Forgiveness Information. Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax withholding to. The paycheck has died read a banner in the symbolic procession which toured the main streets of Argentinas capital and.

Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17. You can calculate the cost using the same method for mortgage tax. Your paycheck might be safe but youll be dinged at the cash register.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Technology Credit Union serving more than 125000 members throughout the San Francisco Bay Area and Silicon Valley. One student loan with Multi-Year Approval.

Illinois has a total of 621411 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Federal government websites often end in gov or mil.

CFL 6055856 Licenses The Mint Mortgage experience is a service offered by Intuit Mortgage Inc a subsidiary of Intuit Inc NMLS 1979518. This table shows the top 5 industries in Illinois by number of loans awarded with average loan amounts and number of jobs reported. Get breaking Finance news and the latest business articles from AOL.

WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return. Multi-factor authentication with layered security keeps you protected against potential attacks or fraud. The calculator also asks you what your age was at the end of the last calendar year.

Confirm that you have entered a valid 9-digit tax ID. In California loans are made or arranged by Intuit. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

One protester carried a clinical history for Argentine wages a chart showing how inflation has eaten up the value of paychecks. Multi-Year Approval lets you apply once to potentially fund for every college year so you can focus on school. Online payroll for small business that is simple accurate and affordable.

Its a hassle to apply for loans each year. This affects the documents you may be required to provide. You must pay tax to Illinois on any income you earn there if you work there and live in any other state except Wisconsin Iowa Kentucky or Michigan.

The gov means its official. Why A Reverse Sales Tax Calculator is Useful. Intuit Personal Loan Platform is a service offered by Intuit Financing Inc.

Territories who are 16 years of age or older are students or prospective students or. Paycheck Protection Program FAQs. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year.

Multi State Payroll

Black And White Labrador Resume Template Resume Objective Resume Objective Examples Resume Objective Statement Examples

New York Hourly Paycheck Calculator Gusto

Pay Stub Meaning What To Include On An Employee Pay Stub

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Leopard Print Undated Portrait Digital Planner Hustle Etsy Budgeting Monthly Budget Planner Digital Planner

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Pay Check Stub Payroll Checks Payroll Template Payroll

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Decoding Your Paystub In 2022 Entertainment Partners

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Loan

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Payroll Calculator Free Employee Payroll Template For Excel

Free Employer Payroll Calculator And 2022 Tax Rates Onpay